Capital allowance claim for the year of assessment 2019 amounts to RM270000. You should indicate by the use of the word Nil any item of income or.

1 Nov 2018 Budgeting Inheritance Tax Finance

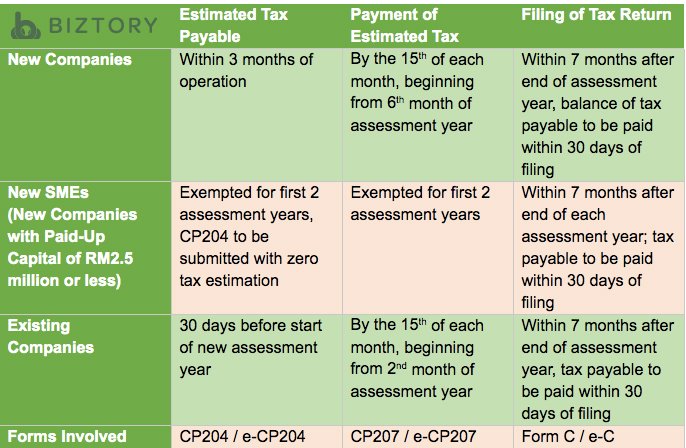

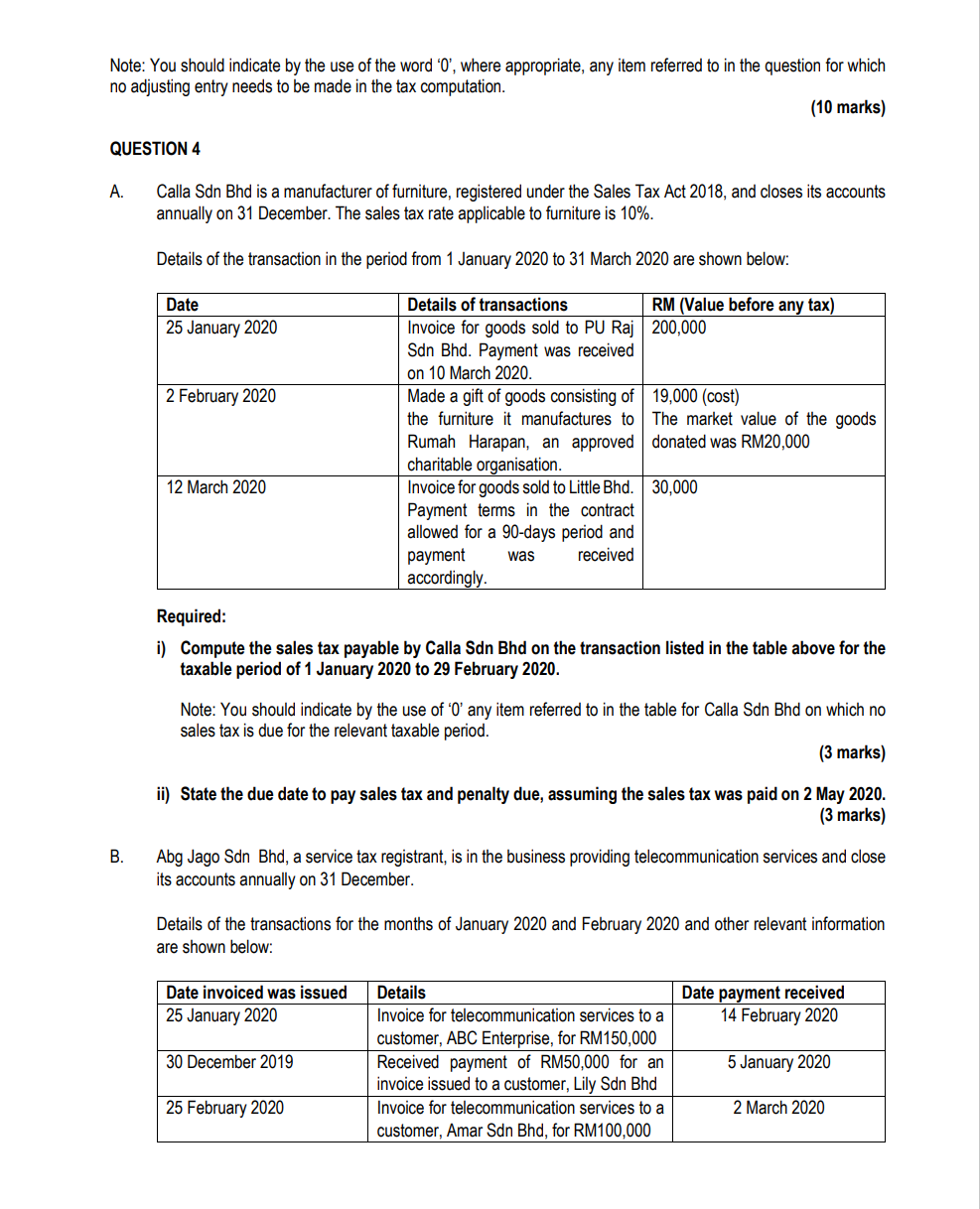

Following table will give you an idea about corporate tax computation in Malaysia.

. On the First 5000. A Sdn Bhd bought a power plant from B Ltd a company resident in India. However there is a non.

1 Report to PandaiBuat Sdn Bhd From Tax Firm To Mr Bok Chek Wai Chief financial officer PandaiBuat Sdn Bhd. With reference to the Income Tax Act 1967 as amended compute the chargeable income of RK Manufacturing Sdn Bhd for the year of assessment 2019. Headquarters of Inland Revenue Board Of Malaysia.

On the chargeable income exceeding RM 600000. Paid-up capital up to RM 25 million or less. The company is liable for corporate tax at a rate of 24 on its taxable income of RM835000.

B Installation and commissioning services. The expenditures incurred by the business are as follow. The fees paid to B Ltd for the services was RM100000.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba. On the first RM 600000 chargeable income. Total Personal Reliefs for YA 2019.

Company with paid up capital not more than RM25 million. On first RM500000 17 Subsequent Balance 24. It should be noted that the above tax rate is only applicable to Private Limited Company Sdn Bhd or Limited.

As a consequence from that merger the top management of. 3 C28 February 2019 Aye Sdn Bhds financial year end is 31 May. Janet would be granted up to RM 20000 in income tax rebates for her Sdn Bhd for the next 3 years if she registers her company from 1 July 2020 to 31 December.

On the First 5000 Next 15000. A Rondo Group Berhad makes up its accounts to 31 December each year. The company issued 650000 10 convertible preference shares of RM1 each.

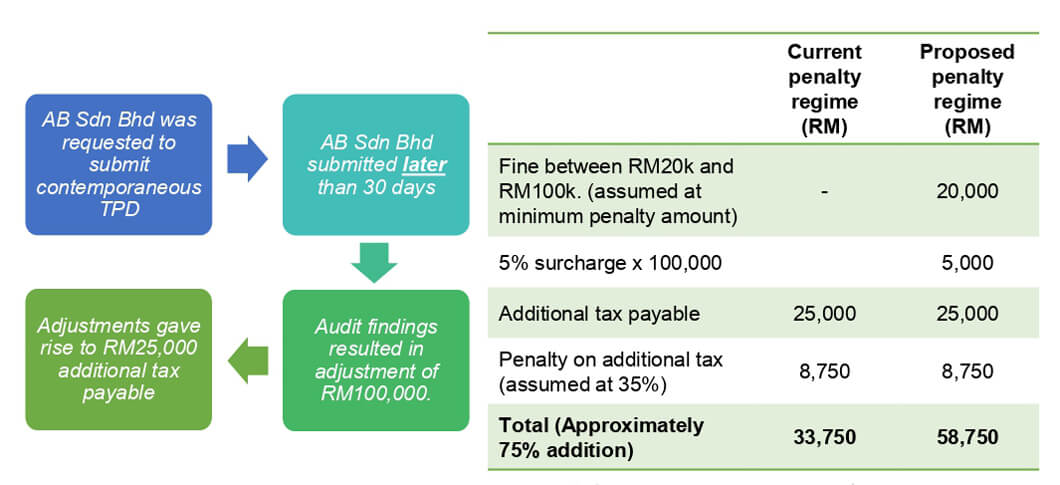

Income tax rates a Companies 24 b Small companies Chargeable income. Enterprise less flexible. Changes in Tax Rate and Penalties.

Every 50 preference shares can be converted into 100 ordinary shares in year 2034. Effective date Year of Assessment YA 2020 and subsequent YAs Changes to Individual Income Tax Rates Highlights of 2020 Budget Gross income RM Chargeable income RM Current Tax Rate 2019 Proposed Tax Rate 2020. There are two revisions available in the sixth month November 2018.

Supervise the installation and operation of the plant from 1542019 to 3152019. On 1 October 2019 Kyasara Sdn Bhd decided to merge with another company named Maxell Sdn Bhd. Only subject to the 17 24 corporation tax rate for small middle size company 3.

Published by Song Liew at December 11 2019. This amount comprises of corporate tax of RM85000 and branch profits tax of RM37500. Date Capital Expenditure RM 15 December 2016 Cost of land 300000 20 January 2017 Clearing of land for plantation 150000 25 July 2017 Construction of store 80000 5 September 2017 Planting of pineapple 200000 10 August 2018 Construction of a surau 35000 On 31 October 2019 Pine Sdn Bhd.

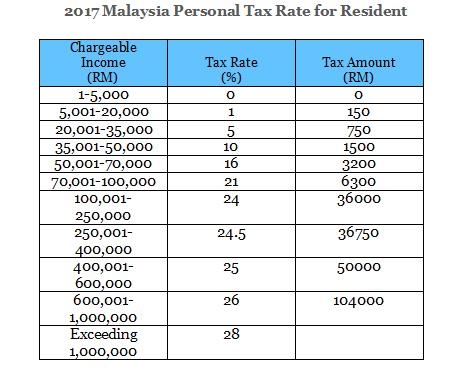

Taxletter Issue 18. Based on the current income tax rates it is ideal to keep her chargeable income at RM 70000 where the maximum income tax rate is 14. The tax rate is 23.

Tax Rate of Company. Redefinition of Small Medium Enterprise SME To support the growth of Malaysian SME it is proposed in Budget 2020 that the income tax rate be revised as follows. The rate of the AIE for PBSB will therefore be 10 of the value of increase in export sales in YA 2020 over that of the preceding year YA 2019.

It has also been proposed that for SME to qualify for the above allowance as well as the reduced tax rate see below the gross income from its business sources should not exceed RM50 million in a basis periodfor a year of assessment. No further penalty will be imposed after 1 September 2020. 25000002500000 over the YA 2019 export sales.

Due date for submission of tax return for YA 2019 is 31 August 2020 If ABC Sdn Bhd fails to pay the balance of tax payable on 31 August 2020 a penalty of 10 of the balance of tax payable will be imposed on 1 September 2020. For non-resident individuals the applicable tax rate is increased by 2 to be in line with the changes which is 30. The amount of tax payable by Dedaun Sdn Bhd for the year ended 31 October 2021 is RM122500.

On 1 January 2019 the company had in issue 340 million ordinary shares of RM2 each. Calculations RM Rate TaxRM A. Tax under section 109B of the ITA at the rate of 10.

1 Corporate Income Tax Rate. The following tax rates are to be used in answering the questions. Paid-up capital over RM 25 million.

The above proposal is effective from YA 2020. Sdn Bhd Corporate Tax. For YA 2019 the basis period is 1 June 2018 to 31 May 2019 and the due date to submit an initial tax estimate is 30 days before the commencement of the basis period for YA 2019 which is 1 May 2018.

Sole proprietor or partners resident individual is taxed on his chargeable income at graduated rates from 1 to 28 after the deduction of tax relief.

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Public Revenue To Shrink To Rm227 3b In 2020 Amid Lower Tax Collection The Edge Markets

Kopiko Sdn Bhd Income Statement For The Year Ended 31 Chegg Com

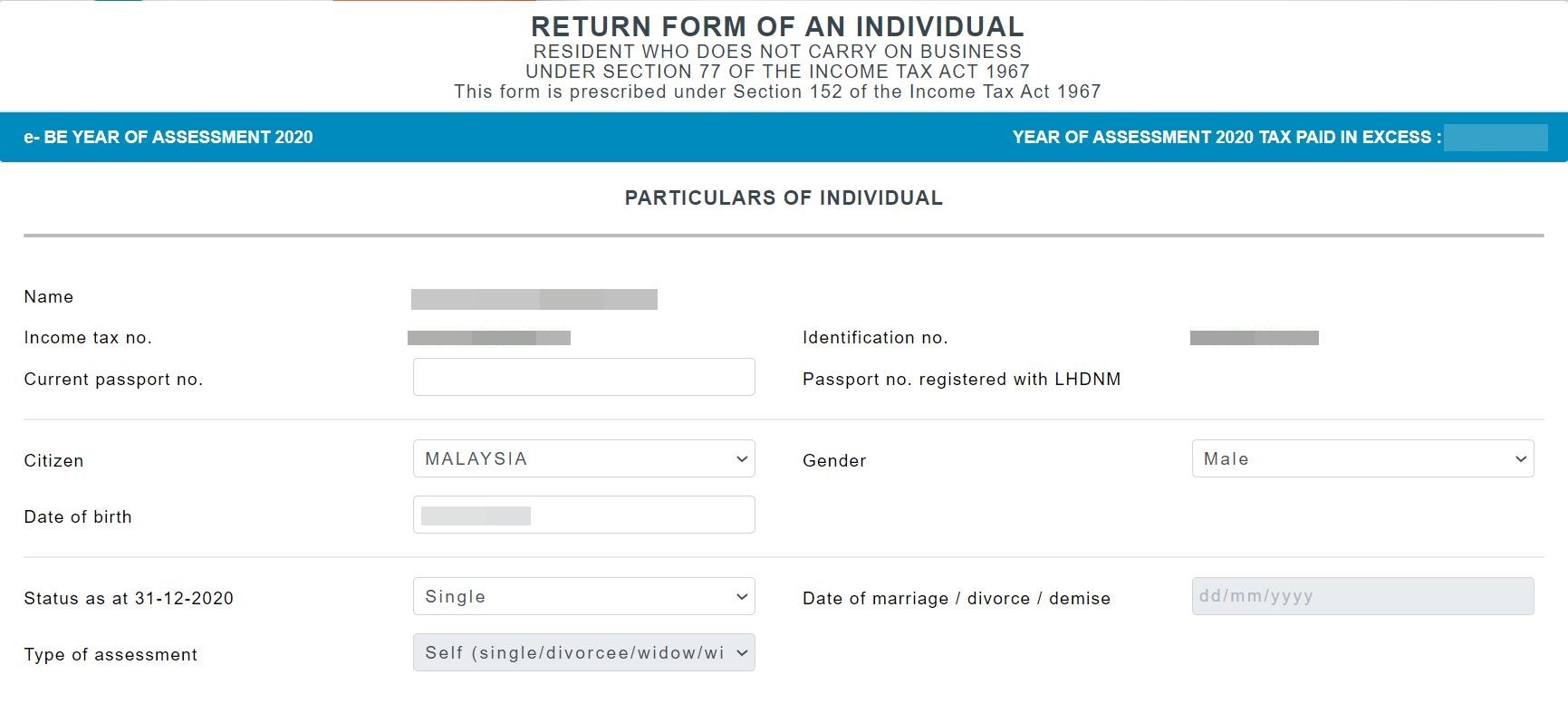

Malaysia Personal Income Tax Guide 2021 Ya 2020

Income Tax Malaysia 2018 Mypf My

Borang Tp 1 Tax Release Form Dna Hr Capital Sdn Bhd

Section B All Six Questions Are Compulsory And Must Chegg Com

Company Tax Rates 2022 Atotaxrates Info

Chile Update On Preferential Tax Regimes International Tax Review

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

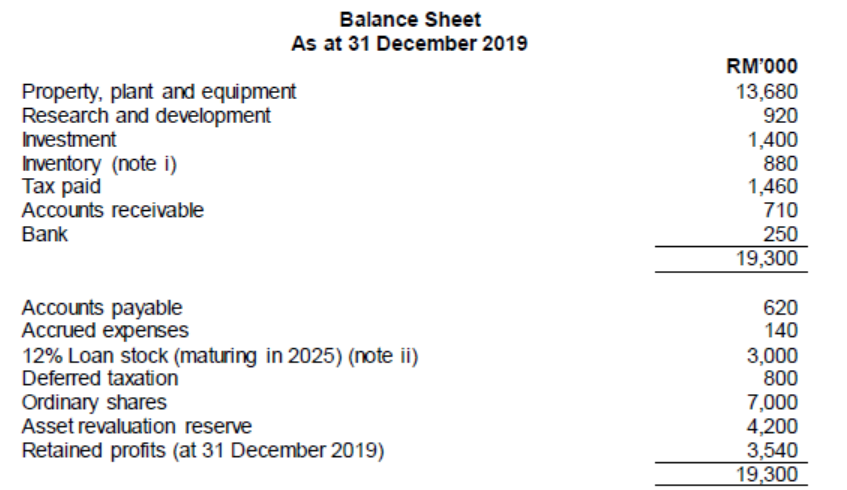

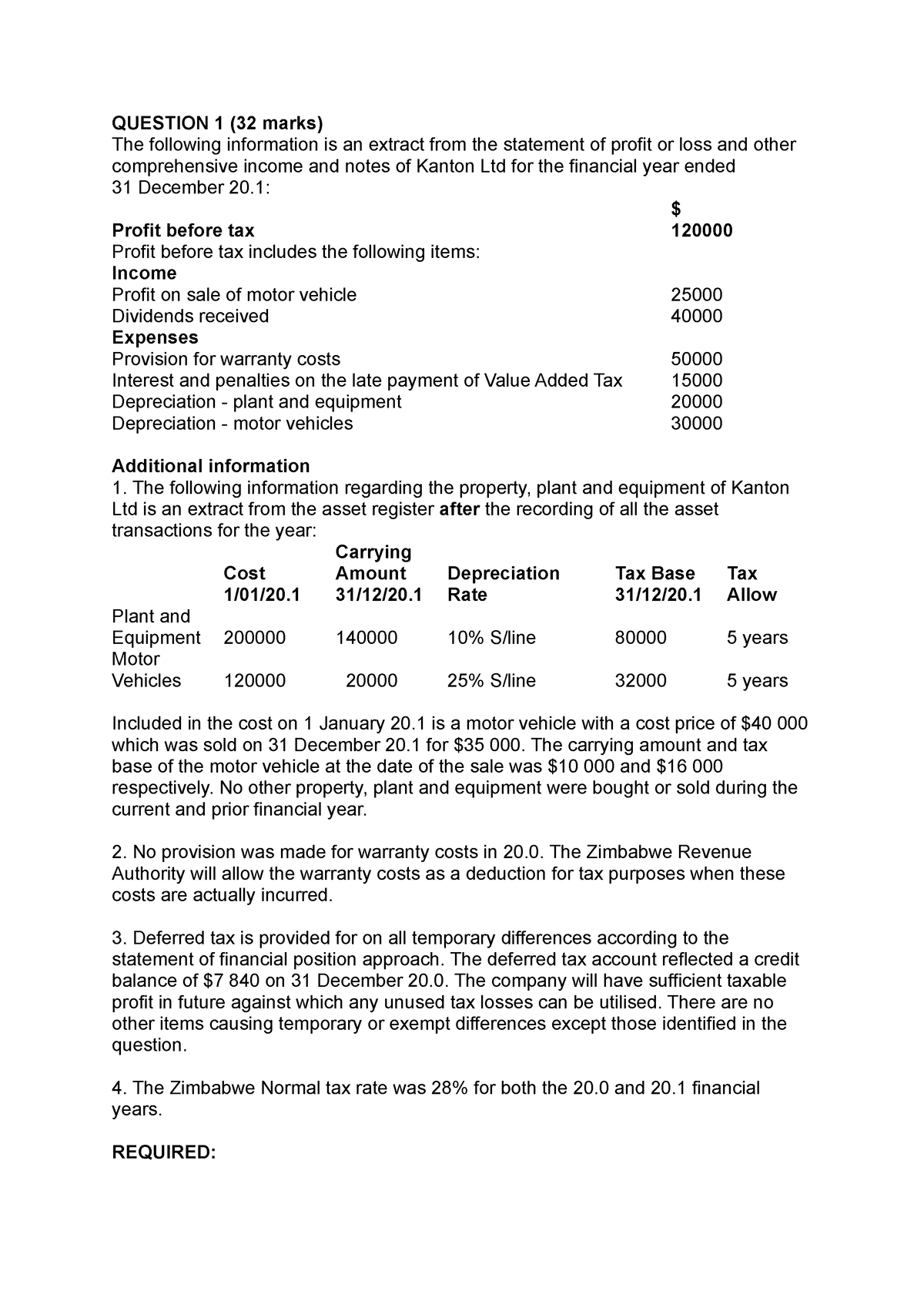

Assignment Question 1 Ias 12 Deferred Tax Question 1 32 Marks The Following Information Is An Studocu

Qatar Currency Timeline Exchange Rate All About Qatari Riyal Qatar Currency Qatari

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Tm2126636 10 S1 None 45 9690156s

The Case For A Robust Attack On The Tax Gap U S Department Of The Treasury

Transfer Pricing Requirements And New Penalties In Malaysia Shinewing Ty Teoh

The Case For A Robust Attack On The Tax Gap U S Department Of The Treasury